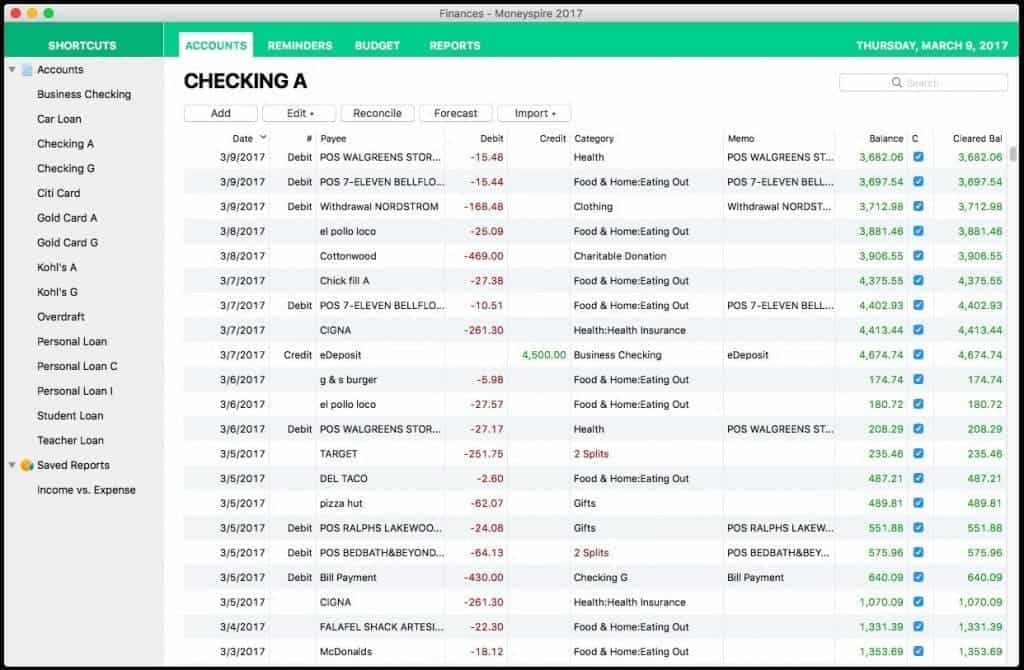

Keep track of your bank accounts, credit cards, etc.There is also a paid version with unlimited accounts available for a one-time fee of $54.Moneyspire is remarkably great personal finance software! Enjoy these benefits:

Moneyspire 2017 review software#

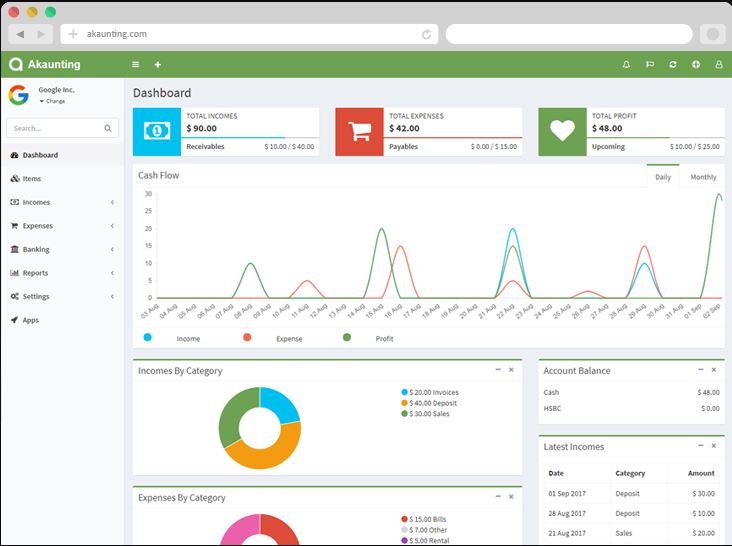

Moneyspire offers a free version of their software for personal use (available for Macintosh, Windows and Linux) that allows you to manage one account and set up to 9 reminders. Account Integration - Service is through Direct Connect, which connects directly to financial institutions rather than a third party.Free Customer Service - Users can access support via email and telephone.Multiple Currency Support - All world currencies are supported on Moneyspire.Moneyspire does not collect or store your financial information. Security - Your data is encrypted and stays on your computer.You can use a cloud server (Dropbox, which gives you 2 GB of storage free, is recommended by Moneyspire), or if you don’t want to put your data on the cloud, you can share it manually through your iTunes account. Apple iOS App Support - You have two ways to share your data with your mobile device.

And your financial data can be exported to a QIF file or a spreadsheet and printed out to share with your accountant. Multiple Data Import/Export Choices - Transactions can be entered manually, downloaded automatically, and/or imported from a QFX/OFX, QIF, or CSV file.It includes a free companion mobile app (available in iOS) that allows you to record transactions and check account balances when you’re out shopping. Moneyspire provides an overview of your financial situation on one easy-to-read screen. Reconcile your checkbook, track credit cards, receive bill reminders, set up automatic bill pay and more.

Moneyspire 2017 review android#

However, with no Android support, a cumbersome signup process and limited functionality, there are better personal finance apps out there. Moneyspire is a personal finance platform that aims to organize your money by keeping track of all of your transactions and helping you with your budget.

Moneyspire 2017 review how to#

How to Boost Your Savings With a CD Ladder.What’s the Difference Between Saving and Investing?.Best High-Yield Savings Accounts For 2021.How to Avoid Capital Gains Tax On Your Investments.How to Pay Less Taxes on a Six-Figure Income.How Taxes Affect Your Investment Portfolio.How to Choose an Online Financial Advisor.Robo Advisors for Socially Responsible Investing.Net Worth Trackers: Apps & Tracking Services.Best Budgeting & Money Management Services.Should You Pay Off Your Mortgage or Invest?.How to Invest in Single-family Rental Homes.How to Invest in Commercial Real Estate.Selling a Rental Property? Decrease Your Tax Burden.Is Real Estate a Good Investment Right Now?.How to Invest in Real Estate With Little Money.How to Cash Out Bitcoin to Your Account.How to Sell Bitcoin and Cryptocurrencies.Tax Guide to Cryptocurrency Investments.Should You Invest in Bitcoin, Forex or the Stock Market?.ETF vs Mutual Funds (and Index Funds) Comparison.How to Beat the Top Traded ETFs & Mutual Funds.Direct Indexing – Beat the Mutual Funds at Their Own Game.How to Invest in Index Funds: Do It Right.Stansberry’s Investment Advisory Newsletter.Best Stock Picking Services & Screeners.Traditional vs Alternative Asset Classes.How to Diversify Your Investment Portfolio.Should ADRs Be Added to Your Portfolio?.

0 kommentar(er)

0 kommentar(er)